Describe How the Valuation Principle Is Used by Financial Managers

Do some research and define and describe the valuation principle. There are five overall principles to managing the financial transactions of sponsored research funds.

1 1 Financial Management Prepared By Yousef El Mudallal Ppt Download

View Homework Help - Principles of Finance Week 2 Discussion from CRITICAL THINKING 102 at East Bladen High School.

. Describe the role costs and benefits play in the valuation principle. Behind every major resource-allocation decision a company makes lies. Describe the role costs.

Uses of Value Additivity Principle Valuation of Firm. Concentration on Wealth Maximization. Do some research and define and describe the valuation principle.

Do some research and define and describe the valuation principle. The value of 1 of the present time is more than the value of 1 after some time or years. Why can there only be one competitive price for a good.

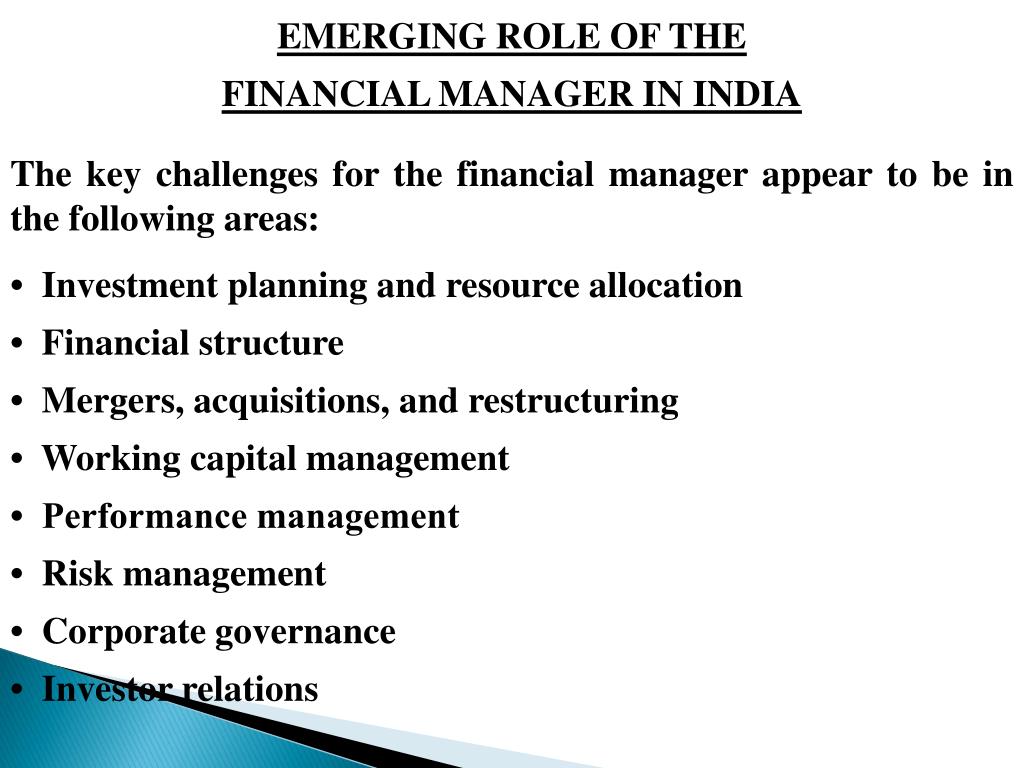

Valuation often relies on fundamental analysis of financial statements of the project business or firm using tools such as discounted cash flow or net present value. The job of a financial manager in a nonprofit organization is different from a financial manager with a profit-seeking firm. Describe how the Valuation Principle is used by financial managers.

If an individual prefers money sooner than later then heshe values a dollar today more than a dollar tomorrow or a dollar in one year. By gaining a comprehensive understanding of financial analysis and valuation executives and other professionals will be able to better assess the financial implications of investments and other business activities and make decisions that create greater value. Valuation Principle is the one unifying principle that underlies all of finance and links all of the ideas throughout this book.

This process is known as the Valuation Principle an analysis between the value of the benefits and the value of its costs. These assets help in generating cash which further helps to repay Equity holders and Debt holders. Aware of Time Value of Money.

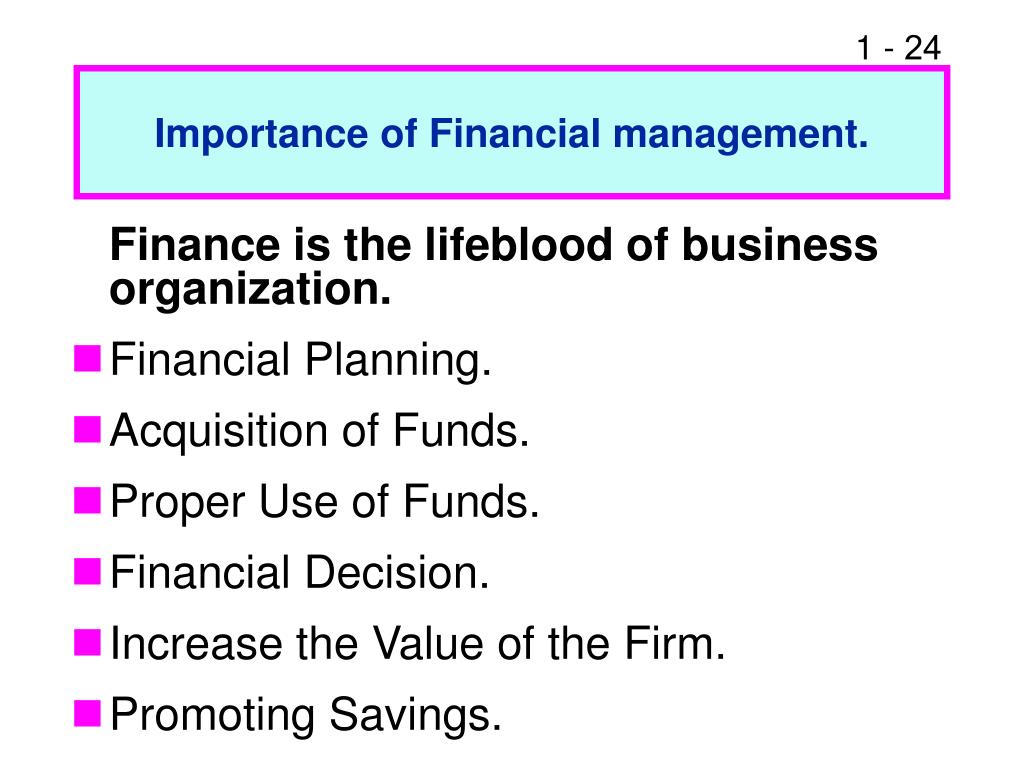

It provides a basis for making decisions within a company. In finance valuation is the process of estimating what something is worth. Financial controls provide the basis for sound management and allow managers to establish guidelines and policies that enable the business to succeed and grow.

Budgeting for instance generally refers to a simple listing of all planned expenses and revenues. Core principles of finance are applicable in the case of principles of financial management. Be sure to cite your source in APA forma.

Your estimate of cash flows not only measures the size but. On the basis of this listing and a starting balance sheet you can project a future one. These people will handle money in different ways.

Thats no longer true. Describe how the Valuation Principle is used by financial managers. -When the value of the benefits exceeds the value of the costs the decision will increase the market value of the firm.

Describe the role costs and benefits play in the valuation principle. The balance sheet income statement and cash flow statement. In general a company can be valued on its own on an absolute basis or else on a relative basis compared.

A General Managers Guide to Valuation. -The value of a commodity or an asset to the firm or its investors is determined by its competitive market price. Trade-off Risk and Return.

The Value of the firm is the total value of all individual assets deployed in the company. The balance sheet provides a snapshot of a companys financial health for a given period. The value of an asset is the present value of its expected returns.

The price determines the value of a good. Take a Right Insurance Plan. Describe how the Valuation Principle is used by financial managers.

It is the idea that an assets worth to a company or an investor is dictated by how competitive its price is in the market. This principle is concerned with the value of money that value of money is decreased when time passes. The five principles are consistency timeliness justification documentation.

Be sure to cite your source in APA format. Principles of Finance Week 2. Up to 5 cash back Good financial management software can show you how even a slight improvement in income can positively change your financial profile.

Valuation used to be the province of finance specialists. Formation of Optimal Capital Structure. Time Value of Money.

Implementation of a companys strategic plan often begins by determining managements basic expectations about future economic competitive and technological conditions and their effects. 39 Describe How and Why Managers Use Budgets. We use the Valuation Principles Law of One Price to derive a central concept in financial economicsthe time value of money.

It is the job of the financial manager to break the idea down into detail to analyze the benefits and the costs and then make a decision based on concrete numbers. Valuation is a quantitative process of determining the fair value of an asset or a firm. Diversification of both Investment and Borrowing.

Five Principles of Financial Transactions Management. PRINCIPLES OF VALUATION Because rational people prefer to receive benefits sooner than later and make sacrifices later than sooner money which provides the option to buy benefits is likewise preferred sooner to later. Maximize Your Employment Benefits Employment benefits like a 401k plan flexible spending accounts and medical and dental insurance yield some of the highest rates of return that you have access to.

You must discount the earnings stream at your required rate of return by estimating the cash flows and your rate. Policies and procedures within Research Accounting Services have been developed in support of these principles. As such an accurate valuation especially of privately owned companies largely depends on the reliability of the firms historic financial.

3 Financial Statements Used by Managers. It lists the assets liabilities and equity line by line for the. The Value Additivity Principle is often used to compute the value of the firm.

F or a financial manager evaluating financial decisions involves computing the net present value of a projects future cash flows. There are three key financial statements managers should know how to read and analyze.

Financial Management Definition Of Financial Management Financial Management

1 1 Financial Management Prepared By Yousef El Mudallal Ppt Download

Principles Of Financial Management The Media Vine Financial Management Financial Management

Financial Management Definition Of Financial Management Financial Management

Ppt Financial Management By Powerpoint Presentation Free Download Id 3926735

Ppt Financial Management By Powerpoint Presentation Free Download Id 3926735

Value Of A Firm Economics Lessons Finance Investing Business Analysis

Learn Accounting Online Managerial Accounting Accounting Learn Accounting

Corporate Finance Understanding The Concept And Principles Finance Infographic Finance Finance Career

What Is Financial Management Definition And Examples

Financial Management Definition Of Financial Management Financial Management

Intangible Assets Intangible Asset Accounting And Finance Bookkeeping Business

1 1 Financial Management Prepared By Yousef El Mudallal Ppt Download

Ppt Financial Management Powerpoint Presentation Free Download Id 4339766

Valuation The Essence Of Corporate Finance Visual Ly Finance Infographic Business Valuation Trade Finance

Financial Management Definition Of Financial Management Financial Management

Comments

Post a Comment